FUND INFORMATION

Objective and Suitability

The primary objective of this fund is to deliver long term capital growth while being 100%

invested in the cryptoasset class. The fund is suitable for medium to long-term investors

seeking high levels of exposure to the top 20 cryptoassets by market capitalisation. The

fund aims to provide investors with an enhanced risk-return measure relative to a pure

market-cap weighted top 20 strategy. Investors should expect moderately high levels of

volatility and potential drawdown of their investment.

Strategy

The CRYPTO20 Fund follows a passive strategy, with the fund parameters and rebalancing

policy expertly curated through data science techniques. CRYPTO20 is invested in the top

20 cryptoassets by market capitalization, with weekly rebalancing. A maximum component

weighting of 10% is utilized to prevent any single asset, and thus single source of risk,

from dominating the portfolio. The fund will utilize assets in the form of staking and other

such methods to generate additional return over and above capital appreciation.

FEES AND BENCHMARK

The fund will incur an annual management fee of 0.5% per annum, accrued monthly.

Further, there will be no performance fees attached due to the passive nature of the fund.

As a result of zero performance fee, there is no specific benchmark the fund aims to

outperform. For comparative purposes however, the fund will be benchmarked against the

performance of the top 20 cryptoassets equally weighted and Bitcoin itself.

PERFORMANCE

| 1M | 3M | 1Yr | |

|---|---|---|---|

| C20 | -20.47% | 40.72% | 641.65% |

| Top 20 | -26.22% | 45.04% | 513.74% |

| BTC | -35.35% | -17.29% | 294.59% |

PERFORMANCE GRAPH*

(1 Year)BITCOIN DOMINANCE*

(1 Year)RISK / RETURN PROFILE

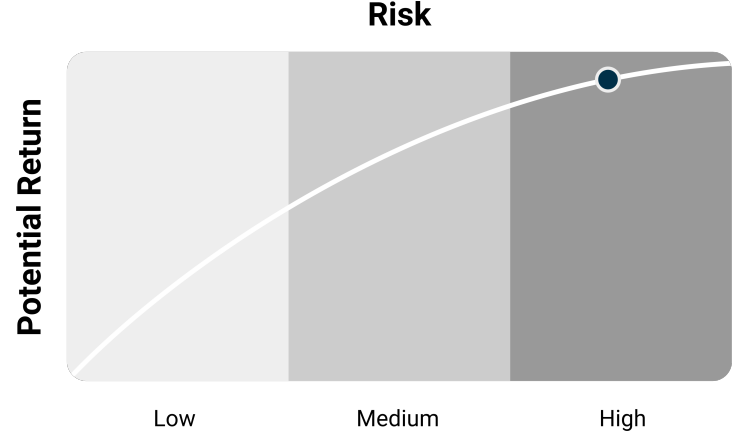

In terms of the above risk/return profile, the CRYPTO20 fund has a high risk rating with

the intention of achieving superior returns relative to the asset class. Risk is defined as the

volatility of the fund returns. Increased risk is accompanied by a greater potential

drawdown of the funds assets. The risk/reward profile is specifically relative to the top 20

cryptoassets (Equally weighted) and incorporates the fund statistics listed below. The

profile is by no means comparable or related to traditional assets or funds.

FUND COMPOSITION

as at 31 May 2021FUND FACTS

| NAV price per token: | $3.7708 |

|---|---|

| Circulating supply: | 18,564,460 |

| Market Cap: | $70,002,422 |

| 30 day high: | $6.0144 |

| 30 day low: | $2.4019 |

| Coins added: | - |

| Coins removed: | - |

| Management Fee: | 0.5% |

Disclaimer

*The performance graphs utilize pricing data from CoinMarketCap for the Top 20

cryptoassets and Bitcoin benchmarks. Actual data is used for C20 performance figures.

This fact sheet does not constitute investment, financial or other advice and is supplied for

information purposes only. Past performance is not a guide to future returns. Every effort

has been made to ensure the accuracy of the information provided, but Invictus Capital

make no warranty regarding such information.